Empower your clients, enhance your services, and earn commissions

As a local broker, you need every advantage to maintain strong client relationships and grow your business By working with PeopleKeep, you can transform the way you work with clients by enabling them to offer affordable health benefits tailored to their unique needs.

✓ Get all the resources you need to assess HRAs for your clients

✓ Remain the agent of record for your clients

✓ Earn commissions

Why partner with PeopleKeep?

Your clients rely on your expertise to find creative solutions to their unique needs. This is especially true if they struggle to provide a health benefit due to the high cost or complexity of traditional options.

By partnering with PeopleKeep, you can unlock access to a modern health benefits solution many other brokers aren’t aware of. We’ll help you become an expert in health reimbursement arrangements (HRAs) so you can help your clients provide health benefits their employees love.

As a partner, you can:

Save your clients

Help your clients who aren’t a good fit for group health insurance control their budgets with no minimum participation requirements.

Earn commissions

When you sign your clients up for PeopleKeep, you’ll earn commissions from us. Plus, you can continue to sell individual health and ancillary policies.

Retain AoR

You can continue to support your clients’ employees as the agent of record when they enroll in a policy. We list you as the preferred broker on their dashboards.

Get dedicated support

We’ll provide educational resources, customer support, and more to help you better care for your clients and understand HRAs.

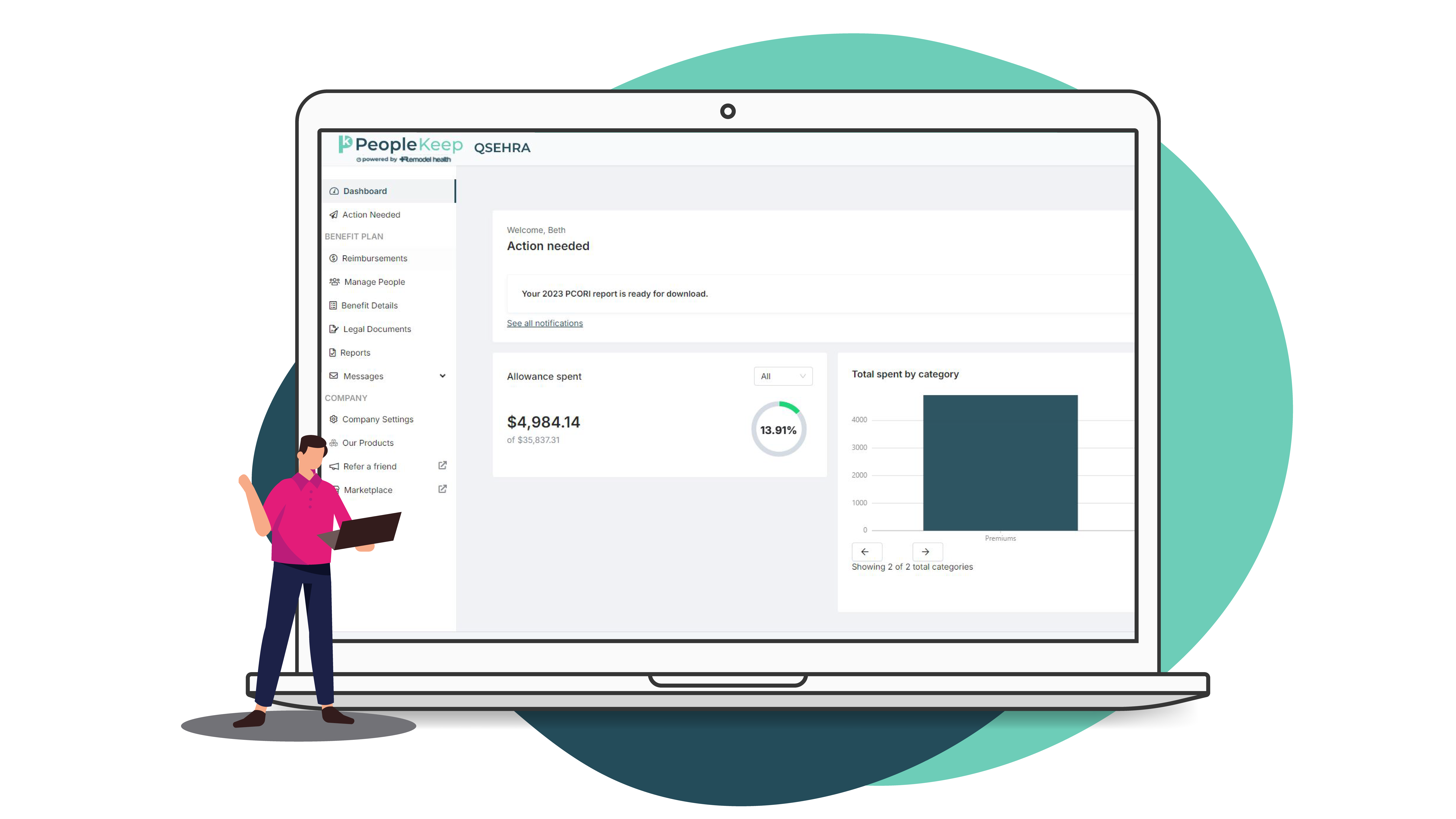

As the leader in cloud-based HRA administration solutions, we’re here to help you support your clients in selecting a health benefit that works for their unique needs and budget. Our platform makes it easy to offer an affordable benefit that reflects an employer’s values while eliminating administrative headaches.

Why should insurance brokers consider HRAs for their clients?

By integrating HRAs into your playbook, you can set your clients up with a flexible, cost-effective health benefit that solves their unique challenges.

Traditional benefits don’t work for every organization. For your smallest clients, a group plan may be out of reach financially. Or your clients may not meet the minimum participation requirements of group health plans. An HRA offers a game-changing solution in the face of these challenges.

By offering this modern, defined contribution health benefit, you not only expand your service offerings but also gain a competitive edge by introducing an innovative solution that many of your peers may overlook.

What is PeopleKeep?

PeopleKeep, powered by Remodel Health, is your partner in offering HRA administration software. Our mission is to make personalized health benefits administration accessible for small and midsize businesses so they can better care for their people. We believe every employee deserves access to health benefits that support their unique needs, and we’re here to make it easy for you to offer those benefits to your clients.

Since starting as Zane Benefits in 2006, we’ve helped thousands of organizations administer their benefits.

QSEHRA

Qualified small employer HRA (QSEHRA). A powerful alternative to group health insurance made specifically for small employers.

ICHRA

Individual coverage HRA (ICHRA) health benefit that enables employers to cover the individual insurance plans their employees choose.

GCHRA

Group coverage HRA (GCHRA) health benefit that employers can use to help employees with their out-of-pocket expenses.

Health reimbursement arrangements (HRAs)

Much like the switch from pension plans to managed individual retirement accounts and 401(k)s, many small employers are switching from group health plans to individualized HRAs.

An HRA is an IRS-approved health benefit that enables employers to reimburse their employees tax-free for qualifying medical expenses such as health insurance premiums and other out-of-pocket expenses. Employers set a monthly allowance for their employees to use and approve their eligible expenses for reimbursement.

Employers can leverage two types of HRAs as alternatives to traditional group health insurance. The qualified small employer HRA (QSEHRA) is specifically designed for small organizations with fewer than 50 full-time equivalent employees (FTEs) that don’t offer a group plan, while an individual coverage HRA (ICHRA) is an excellent option for employers of all sizes.

Your clients that offer a group plan can pair it with a group coverage HRA (GCHRA) to supplement their employees’ health benefits and cover out-of-pocket expenses.

Testimonials

"PeopleKeep made the whole process of setting up and administering an ICHRA super easy! They take care of everything from start to finish!"

Joey Raab

| Insurance Depot

“Our experience with PeopleKeep's customer support team has been great! Our customer success manager has also been knowledgeable, helpful, and excellent at providing relevant information to our team.”

Janan Sirhan

| Impactual LLC

"Our client [...] had a previous provider offer a QSEHRA, which was great. But the vendor disappeared and was not available to answer any questions or help them. PeopleKeep was amazing. They were timely and supportive."

Robin Throckmorton

| Strategic HR Business Advisors of Clark Schaefer Hackett

Partnering with PeopleKeep vs. other HRA providers

| PeopleKeep | Others | |

| You remain the IFP agent of record | ✓ | X |

| You receive commissions when you sign your clients up for an HRA | ✓ | ✓ |

| Your client’s employees are sent back to you to find individual health insurance policies | ✓ | X |

| You can still sell individual ancillary products to client’s employees | ✓ | X |

How am I compensated?

You earn commissions when you sign your clients up for an HRA with PeopleKeep. We base compensation on the number of seats on the software, not the total lives covered.

As a bonus, when you partner with us, we’ll waive your clients’ $150 sign-up fee.

Broker Resources

How to grow your insurance book of business with an HRA.

This blog discusses ways to create and grow your insurance book of business, including how an HRA can help you meet your business goals.

Top challenges facing health insurance professionals

Selling health insurance to SMBs: Tips for brokers

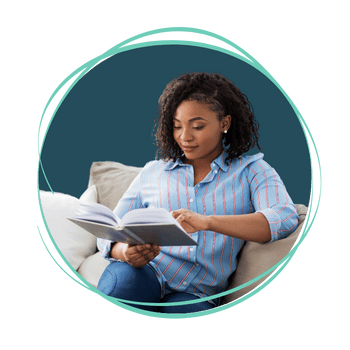

Ebook Resource

How brokers can prepare for open enrollment

Partner with PeopleKeep

Join the partner program and better serve the needs of your clients.

Frequency Asked Questions

If your clients can’t afford a traditional group plan, face steep annual rate increases, or don’t meet minimum participation requirements, an HRA is often a better solution. Any organization with fewer than 50 full-time equivalent employees (FTEs) that doesn’t offer a group plan of any kind can offer a QSEHRA. Organizations of all sizes can offer an ICHRA.

There are a few factors to consider when deciding between a QSEHRA or ICHRA:

- APTC compatibility: If an employee’s QSEHRA allowance is unaffordable, they can collect their premium tax credits. However, they must reduce their credit dollar-for-dollar by the amount of their QSEHRA allowance. If an employee’s ICHRA allowance is unaffordable, they must choose between an ICHRA or their tax credits. They can’t collect both.

- Allowance caps: The IRS caps QSEHRA allowances, but your clients can offer as much as they want with an ICHRA.

- Ability to sell ancillary group products: Your clients can’t offer any group health plans alongside a QSEHRA, including dental and vision. However, you can offer group ancillaries alongside an ICHRA.

Yes, you remain the agent of record for your clients.

Yes, HRAs are HSA compatible with some special considerations. Our resources below explain the details for ICHRAs and QSEHRAs.