What can an HRA reimburse?

Health Benefits • February 21, 2025 at 3:45 PM • Written by: Elizabeth Walker

Offering health benefits can be expensive and complex, especially for small businesses. That’s why health reimbursement arrangements (HRAs) are becoming a popular alternative to group health insurance. With an HRA, employers can provide tax-free reimbursements for employees’ out-of-pocket medical expenses. But with so many eligible expenses, it can be tricky to know what’s covered.

Depending on which type of HRA you offer and how you design your benefit, you can reimburse employees for more than 200 items outlined in IRS Publication 502 and the CARES Act1. To make it easier, we’ve compiled a summary to help you and your employees understand what an HRA can cover.

In this blog post, you’ll learn:

- How HRAs work, including the different types of HRAs and their benefits.

- The wide range of medical expenses that HRAs can reimburse.

- How employees can make the most of their HRA allowances.

Looking for a quick reference? Download our infographic for a visual guide to HRA-eligible expenses.

How does an HRA work?

With an HRA, you give eligible employees a monthly allowance for medical care. Depending on your HRA type, the IRS may set annual contribution limits that cap how much of an allowance you can offer. Once an employee buys an eligible medical expense and submits claim documentation, you reimburse them tax-free up to their set allowance amount.

HRA allowances can roll over monthly. But unlike a health savings account (HSA), unused HRA funds stay with you at the end of the year and if an employee leaves your company. This gives employers more control over their benefits budget and gives employees more flexibility over their healthcare spending.

Lastly, all types of HRAs are tax-advantaged benefits for employers and employees. Reimbursements are tax-deductible and payroll tax-free for employers. They’re also income-tax-free for your staff.

Now that you know how HRAs work, let’s review the two main categories eligible for reimbursement.

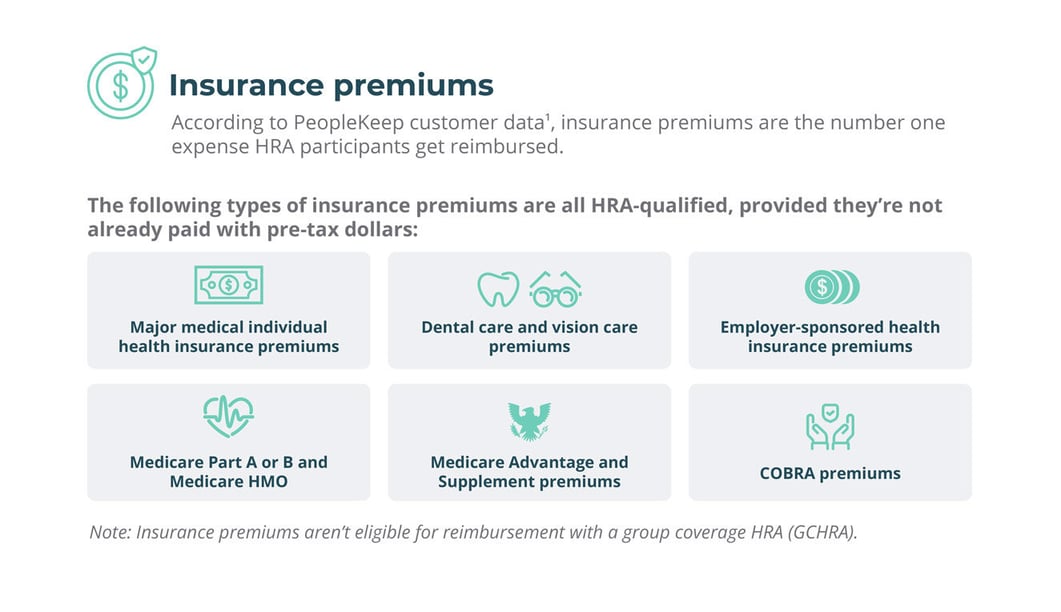

1. Insurance premiums

The first category is insurance premiums. You can reimburse employees for individual health insurance premiums if you offer a qualified small employer HRA (QSEHRA) or an individual coverage HRA (ICHRA). But you can’t reimburse employees for insurance premiums with a group coverage HRA (GCHRA).

Remember that if you’re paying for an insurance policy with pre-tax dollars, you can’t receive reimbursement for the payment through an HRA. Because an HRA is a tax-free benefit, this rule prevents you from receiving tax-free reimbursements for the costs, which the federal government considers “double dipping.” This prevents employees from paying an expense pre-tax and also getting reimbursed for that same cost.

The following insurance premiums are HRA-qualified expenses:

- Major medical individual health plan premiums

- This includes plans on public health exchanges, such as the federal Health Insurance Marketplace and state-based marketplaces. Private exchange plans that provide minimum essential coverage (MEC) are also eligible.

- Dental and vision plan premiums

- Medicare premiums

- However, there are coordination rules your employees must follow if using an HRA with Medicare.

- Long-term care premiums

- COBRA premiums

Health insurance premium payments typically reoccur monthly. To account for this, employees can submit proof of their monthly premium amount once at the beginning of the plan year. If the amount, provider, and timing of their previously approved expense don’t change, employees can receive automatic monthly reimbursements for the premium.

Depending on your HRA type and plan design, you can reimburse health plan premiums only or out-of-pocket expenses in addition to premiums. According to our 2024 QSEHRA Report, individual health insurance premiums are the number one expense employees request for reimbursement.

If you have the budget, setting an allowance that allows your employees to receive reimbursement for premiums and out-of-pocket expenses can help them get the most bang for their buck out of their HRA.

2. Out-of-pocket expenses

Next, there are out-of-pocket medical expenses. This includes any qualifying medical costs an employee’s health plan doesn’t cover or anything their insurance company expects them to pay for on their own, such as a copayment. If an employee has unused HRA funds, out-of-pocket expenses are a good way to spend them.

Qualifying out-of-pocket healthcare expenses include:

- Healthcare provider visits

- Dental and vision care

- Occupational therapy

- Prescription drugs

- Over-the-counter medication

- Mental health counseling

Depending on the type of out-of-pocket cost your employees incur, they must submit different claim documents for reimbursement. You should include claim information in your HRA’s plan documents along with the medical expenses the benefit covers. However, we’ll go over the three different expense category types in the sections below.

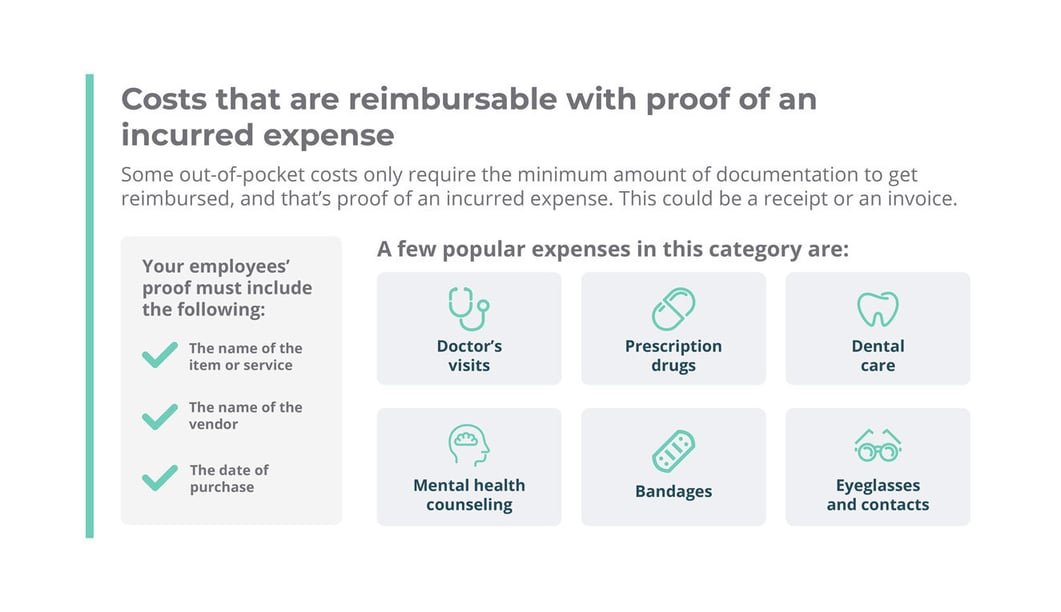

Costs that are reimbursable with proof of an incurred expense

Some out-of-pocket expenses require your employees only to submit a minimum amount of documentation. This proof of an incurred cost is typically in the form of a receipt or an invoice.

Your employees’ proof must include the following:

- The name of the item or medical service

- The name of the vendor

- The date of purchase

This category would include any qualifying medical expenses employees must pay out-of-pocket before they meet their plan’s annual deductible or out-of-pocket maximum. Some examples are psychiatric care, diagnostic services, physical exams, and chiropractic care.

This group also includes smaller expenses like several over-the-counter drugs. These can include:

- Cough syrup

- Eye drops

- Sunscreens with SPF 15 or higher

- Prescription eyeglasses and contact lenses

- Acne treatment

Many HRAs don’t roll over year to year. So, your employees may want to stock up on a few of these items before the new plan year starts to fully take advantage of their benefits.

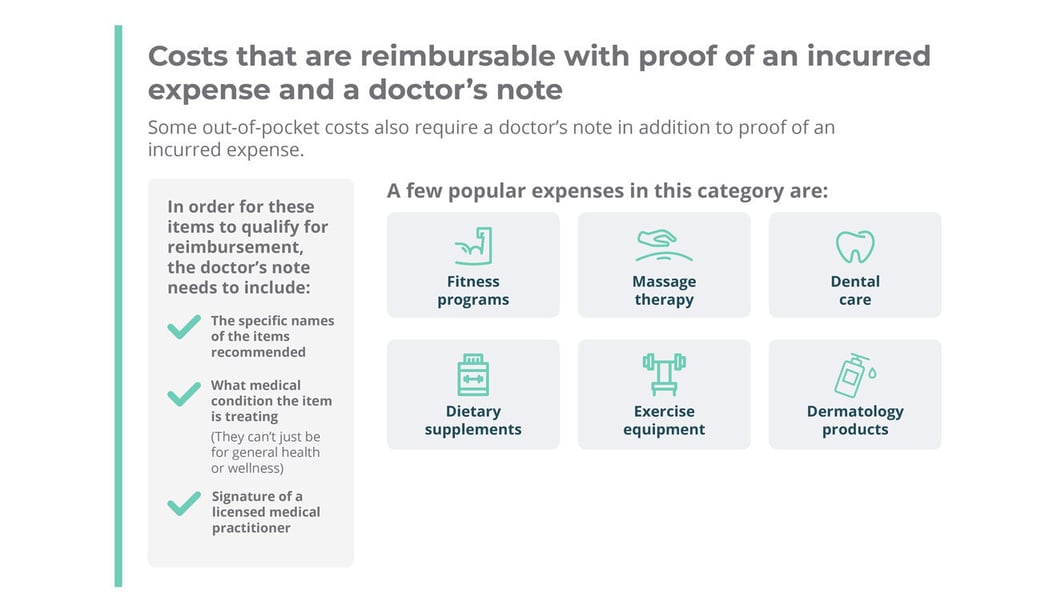

Costs that are reimbursable with proof of an incurred expense and a doctor’s note

Next, discuss qualified expenses requiring proof and a doctor’s note. For example, many over-the-counter items are eligible for reimbursement. But, some need your employees to provide a doctor’s note explaining why the services or item is medically necessary.

For these items to qualify for reimbursement, the doctor’s note needs to include:

- The specific names of the recommended medical service or item

- What medical condition the service or item is treating

- Items that are for general health or wellness are ineligible. A doctor’s note must show medical necessity.

- The signature of a licensed medical practitioner

The following are HRA-eligible items or services that are reimbursable with a doctor’s note:

- Fitness programs

- Dental veneers

- Massage therapy

- Dietary supplements

- Exercise equipment

- Special foods

- Dermatology products

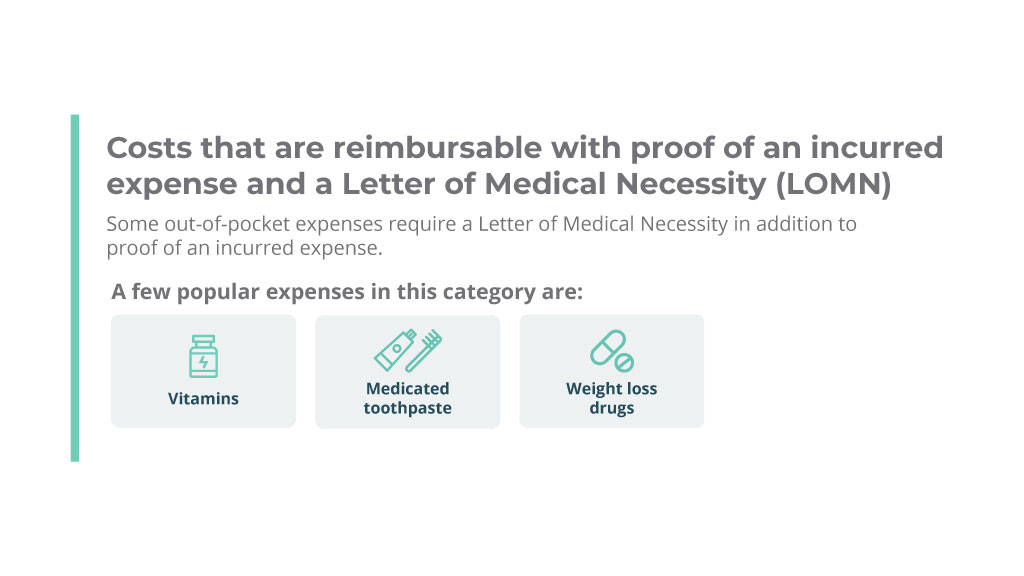

Costs that are reimbursable with proof of an incurred expense and a prescription

The last category is qualified expenses reimbursable with proof and a prescription. Eligible items that employees can receive reimbursements for with a prescription include vitamins and medicated toothpaste.

Employees don’t need to submit their prescriptions to receive reimbursements. This is because certain drugs already require a doctor's prescription to pick up the item from the pharmacy. Therefore, you don’t need to ask employees to submit proof of their prescription.

Your employees will simply submit a receipt showing any out-of-pocket costs, like a copay or coinsurance, that they paid for the prescription.

What are examples of ineligible HRA expenses?

Any medical expenses not included in IRS Publication 502 or the CARES Act are ineligible for reimbursement with an HRA.

Examples of items ineligible for reimbursement are:

- Adoption fees

- Cancer insurance plan premiums

- Cosmetic procedures or surgery

- CPR classes

- Business expenses

- General dental products, such as standard toothpaste

- Hair removal medical treatment or hair transplants

- Child care

- Meals and lodging when away from home for medical treatment

- Maternity clothes

- General vitamins and dietary supplements without a doctor’s note

While the above list isn’t complete, it provides an idea of what expenses you can’t have reimbursed with an HRA.

Want to supplement your HRA? Consider a health stipend.

If an HRA doesn’t cover all the healthcare items your employees need or you simply want to boost your HRA benefit, you can offer a health stipend.

A health stipend works similarly to an HRA. It allows you to reimburse your employees for medical care costs, including out-of-pocket expenses and health insurance premiums. But a health stipend is less federally-regulated. So, you can use a stipend to reimburse more medical services and items than the IRS allows.

For example, a weight loss program isn’t an HRA-eligible expense unless it’s doctor-supervised and the employee provides a medical determination letter. But with a health stipend, you can reimburse an employee for a general weight loss program without a doctor’s note.

Below are some other key features of a health stipend:

- You can offer a health stipend annually, as a one-time spot bonus, or regularly, such as a monthly or quarterly allowance. There are also no annual contribution limits, so you can offer as much as your budget allows.

- By law, you can’t require your employees to buy a medical insurance plan with their stipend funds, nor can you ask for proof that they did. Doing so would change your stipend into a more formal reimbursement benefit and subject it to additional requirements.

- However, you can require claim documentation for direct primary care or healthcare sharing membership fees.

- Health stipends are taxable for employers and employees. An HRA is a better option if you and your employees want tax advantages.

- A stipend isn’t a formal health benefit. So, it doesn’t satisfy the Affordable Care Act’s employer mandate for organizations with 50 or more full-time equivalent employees (FTEs).

- If your business grows to the size of an applicable large employer (ALE), you can opt for the ICHRA and design the benefit to comply with ACA requirements.

- Health stipends are excellent for 1099 contractors and international workers who can’t participate in an HRA. It also benefits employees who receive advance premium tax credits (APTCs) and remote workers who live in multiple states.

Lastly, you can offer a stipend alongside any type of HRA or medical insurance plan to cover additional healthcare costs. This makes a stipend a flexible addition to your benefits package without any extra compliance regulations.

Conclusion

An HRA is ideal for organizations looking to offer their employees a comprehensive health benefit. Communicating how employees can get the most out of their HRA ensures your employees spend their HRA funds wisely. It also allows you to recruit and retain top talent more effectively.

If you’re ready to offer your employees an HRA or health stipend, PeopleKeep by Remodel Health can help! Our health benefits administration software makes setting up perks for your organization quick and easy. Schedule a call with us today to see how we can help get you started.

This article was originally published on February 10, 2020. It was last updated on February 21, 2025.

1. CARES Act

Learn more about how health stipends differ from HRAs with our comparison chart.

Elizabeth Walker

Elizabeth Walker is a content marketing specialist at PeopleKeep. Since starting with the company in April 2021, she has become well-versed in writing about HRAs, health benefits, and small business solutions. Outside of her expertise in the healthcare benefits industry, Elizabeth has been a writer for more than 20 years and has written several poems and short stories. She's published two children’s books in 2019 and 2021, which she is developing into a series of collected works. Her educational background as a classical musician and love of the arts continue to inspire her writing and strengthen her ability to be creative.