Integrated vs. stand-alone HRA

As healthcare costs continue to rise, some employers are struggling to support their employees' needs while sticking to a reasonable budget. One solution for af …

W-2 reporting requirements for QSEHRA benefits

Ever since the 21st Century Cures Act introduced the qualified small employer health reimbursement arrangement (QSEHRA) in 2017, many small employers have had q …

The four best health insurance options for solo pastors

For a big church with several pastors, responsibilities are often shared. However, solo pastors at smaller churches often carry the weight of all responsibiliti …

Health insurance reimbursements: What are the options?

Because the cost of group health insurance is rising every year—for both employers and employees—some employers have sought alternative health benefit options. …

QSEHRA self-administration for first-timers

If you’re a small business owner offering health benefits to your employees for the first time, the qualified small employer health reimbursement arrangement (Q …

Health insurance stipends pros and cons

Many small employers who can't afford to offer formal health benefits may decide to give employees a taxable stipend to pay for healthcare expenses. While this …

QSEHRA plan document requirements

The budget-friendly qualified small employer health reimbursement arrangement (QSEHRA) has made offering health benefits possible for small employers. A QSEHRA …

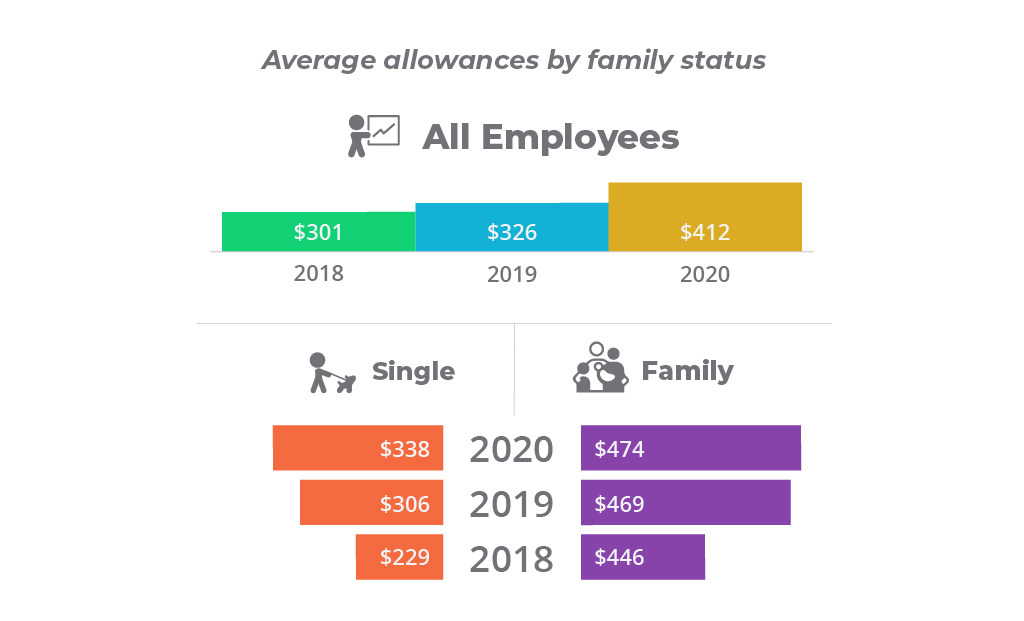

2022 QSEHRA Annual Report

Since it first became available in 2017, the qualified small employer HRA (QSEHRA) has been offering small employers the unique opportunity to reimburse their e …

2021 QSEHRA Annual Report on Nonprofit Organizations

We're back with our third annual QSEHRA report on nonprofit organizations (NPOs) to show how they used the benefit in 2020 and compare that to previous years tp …