Five ways the American Rescue Plan will help you get health coverage

Health Benefits • March 12, 2021 at 8:45 AM • Written by: Gabrielle Smith

With the world still reeling from the effects of the COVID-19 pandemic, President Biden proposed bill H.R. 1319, more commonly known as the American Rescue Plan Act of 2021, to offer relief from both the economic and health effects caused by the virus.

After successfully passing through both the U.S. Senate and House of Representatives, the bill was officially signed into law on March 11, 2021.

While the legislation offers relief in the form of direct cash payments to citizens, increased COVID-19 testing, updated unemployment regulations, and more, there’s a big question that still remains: How does the American Rescue Plan impact my health coverage?

In this article, we’ll cover five major changes the American Rescue Plan has made that are specifically designed to increase your access to health coverage.

1. Expanded health insurance subsidies for the next two years

Back in 2014, the U.S. government began offering premium tax credits, also known as health insurance premium subsidies, to help lower the cost paid for individual health insurance premiums purchased through the public health insurance exchanges.

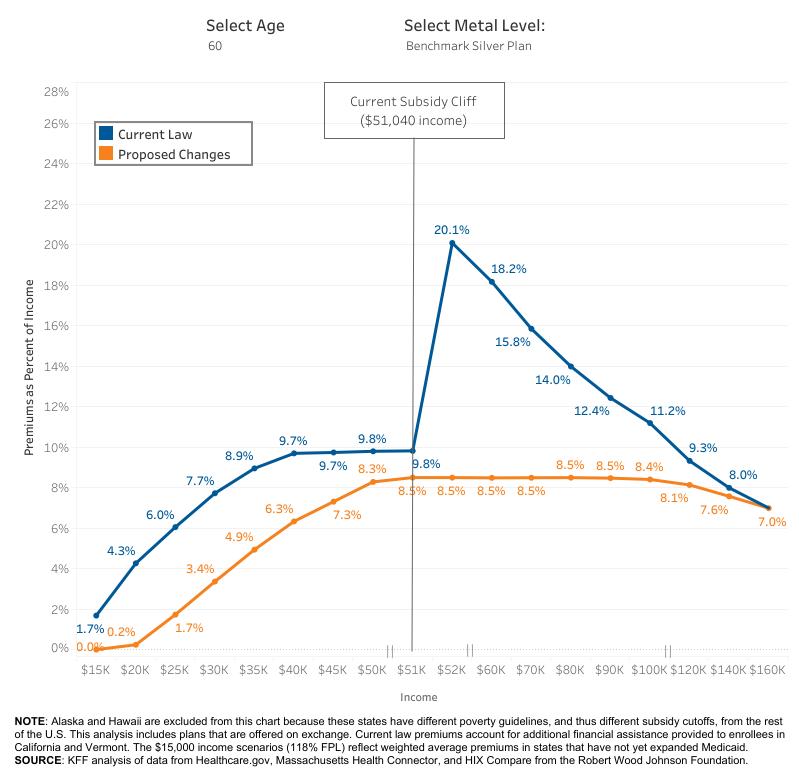

You qualified if your household income fell between 100% and 400% of the federal poverty line (between $12,760 and $51,040 if you’re single) and if you didn’t have affordable coverage through an employer or government program.

Now, all Americans who purchase health insurance under the federal exchanges or state-run markets will pay no more than 8.5% of their household income through the end of 2022.

Here’s how the subsidies will break down during this two-year period:

What does this look like in real life? Let’s use an example.

A family of four making $85,000 paying $25,000 in annual health insurance premiums will go from getting no federal support to paying no more than $7,000 for insurance. In other words, your subsidies for your coverage will go from $0 to $18,000.

Learn more about how the IRS calculates your income here.

2. Cost-sharing for more unemployed Americans

The American Rescue Plan also aims to offer a lifeline to the record number of unemployed Americans which, at its peak, grew to proportions the U.S. hadn’t seen since the Great Depression.

Currently, the Affordable Care Act mandates that insurers reduce cost-sharing (think deductibles, copays, or similar charges) in phased amounts for unemployed Americans enrolled in a qualifying health plan who make between 100% and 400% of the FPL.

The changes made under the American Rescue Plan will make it so any American who receives unemployment compensation in 2021 will qualify for these cost-sharing reductions—not just the ones who have a certain health plan or income level.

3. Fully covered insurance premiums for COBRA participants

Quick summary on COBRA—the Consolidated Omnibus Budget Reconciliation Act is what allows certain employees, retirees, spouses, former spouses, and dependent children the right to temporarily continue their employer-sponsored health benefits that would otherwise end after leaving their job.

Normally, COBRA participants are expected to pay the full premium of their employer’s insurance plan—a costly expense to someone who has recently become unemployed.

Through the American Rescue Plan, eligible COBRA participants (in this case, that would include those who were laid off, furloughed, or had a reduction in hours—not those that voluntarily left their jobs) will receive a 100% subsidy, allowing them to stay on their employer’s insurance plan, cost-free, through the end of September 2021.

4. Funding for rural hospitals and providers

Rural areas are another group hit hard by the pandemic. An analysis conducted by the Rural Policy Research Institute found that 111 rural counties don’t have a single pharmacy available to administer vaccines.

What’s more, a study from the Chartis Center for Rural Health finds that nearly half of rural hospitals are losing money, with 450 facilities at risk of closing completely. Without these facilities in place, health care becomes even less accessible to struggling rural communities that are already short on locations.

The American Rescue Plan includes rural healthcare grants to provide funding for COVID-19-related expenses and any lost revenue to maintain capacity, such as increasing capacity for vaccine distribution or telehealth capabilities.

5. Mental health support

COVID-19 hasn’t just taken its toll on the physical health of Americans, but our mental health as well. The Kaiser Family Foundation finds that roughly four out of ten adults reported symptoms of anxiety or depression during the pandemic, compared to only one in ten in January of 2019.

Given this trend, the American Rescue Plan is set to offer $80 million to the Pediatric Mental Health Care Access Program—a program that promotes behavioral health integration into pediatric primary care using telehealth.

Additionally, another $420 million is budgeted for the Community Behavioral Health Clinics—entities designed to provide a comprehensive range of mental health and substance use disorder services to those in need.

Conclusion

To a nation still suffering the effects of a global pandemic more than a year after it created a masked and socially distant world, the American Rescue Plan serves as a beacon of hope. With lowered costs for health insurance, extended support for the unemployed, much-needed funding for struggling hospitals, and more—this is undoubtedly a win for Americans’ access to health coverage.