Ten Questions to Ask Defined Contribution Providers

Defined Contribution Health Plans • August 8, 2013 at 11:00 AM • Written by: PeopleKeep Team

Defined contribution health plans are a new alternative to employer-sponsored health insurance, and growing in popularity for small businesses who want to offer health benefits for the first time. With a defined contribution health plan, the employer controls how much to contribute to employees' health care expenses. Employers use a defined contribution provider for compliance and administration reasons. For background, see this article on defined contribution software.

Ten Questions to Ask Defined Contribution Providers

If you're like many businesses, you've researched employee health benefits, decided to use a defined contribution health plan approach, and are now researching providers to set up and administer the defined contribution health plan. Knowing what questions to ask providers is key to choosing the best defined contribution provider for you and your employees.

Here are 10 questions to ask defined contribution providers when shopping for and buying defined contribution health plan software.

#1) How long does it take to set up and generate the defined contribution health plan documents?

Once you have made the decision to offer a defined contribution health plan, it should take less than an hour to design a plan, enroll participants/employees, and download the legal plan documents. Look for a defined contribution software provider that offers paperless setup and paperless employee enrollment. Also look for a defined contribution platform that allows you to administer the plan in 5-10 minutes a month.

#2) What are the different plan options? Can we set up different allowances by type of employee?

Look for a defined contribution provider that offers plan design flexibility, such as designing different employee classes or setting cost sharing options. The platform should allow you to give employees allowances monthly or at any time on an exception basis—with automatic monitoring of HIPAA and ERISA discrimination compliance rules.

#3) Where will employees purchase individual health insurance?

Look for a defined contribution platform that makes it easy for employees to shop for and purchase individual health insurance policies, ideally directing employees to a designated broker for quotes.

Employers using defined contribution to administer pure defined contribution health plans (i.e. no group plan), or those using the plan for less expensive dependent coverage, should have their plan software automatically provide their health insurance broker a CRM (Customer Relationship Manager) to best serve their employees—including automatic notification to the broker when an employee’s plan status changes due to family additions, promotions, high claims, etc.

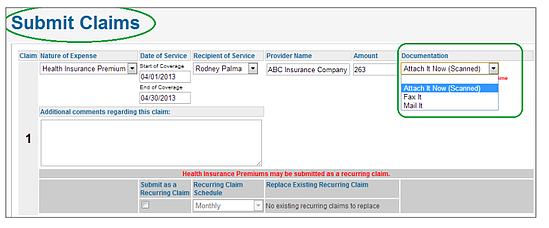

#4) How do employees submit claims for reimbursement? How fast are claims processed?

Employees should be able to submit claims (requests for reimbursement) online, by fax, or by mail, and immediately receive an email acknowledging their claim and providing an online link to monitor claim status. Premium receipts should be permanently available online for convenient access by employees.

Look for a defined contribution provider that offers online claim submission, an easy-to-use employee portal, and processes the reimbursement claims within 24 hours. Employees should be able to inquire about their claim via online chat, email, fax, mail or telephone. No claim should be rejected for improper or incomplete submission without multiple contacts. All employee contact should leave clear audit trails and meet appropriate regulatory guidelines (e.g. IRS, HIPAA, ERISA, SAS 70, ACA).

#5) How are the reimbursements handled? Is pre-funding required, and how is it integrated with our payroll system?

With defined contribution, the employer reimburses employees directly. This way, funds stay with the company until the reimbursements are made and pre-funding of third party accounts is not required. When the reimbursements are recorded through the defined contribution software, look for a provider that offers easy integration with your existing payroll system.

#6) How are employees notified of the status of their claims? What happens if they submit a claim incorrectly?

As soon as an employee submits a claim for reimbursement, employees should be notified by e-mail that the claim has been received and is awaiting processing. Once the claim is processed they should again notified by e-mail. Likewise, if there are any concerns with the claim during processing, they should be notified by email describing what further documentation or information is required. In other words, look for a defined contribution provider that offers responsive claims processing, and provides 24-7 tracking of claim status through the online employee portal.

#7) Who can an employee talk to if they have questions/concerns about their claims?

Look for a defined contribution software provider who provides responsive support, available through email, telephone, and online chat.

#8) How can I find out about other companies experience with defined contribution? Do you have case studies available?

Ask the defined contribution provider for case studies or client success stories. This will help demonstrate how defined contribution works for real companies and nonprofits. For example, see these defined contribution case studies. Ask about the provider's client retention rate. This will provide you a solid idea about client satisfaction and service.

#9) What are the fees associated with a defined contribution health plan? What is the fee structure?

With a defined contribution plan, the employer sets the amount to contribute to employees' healthcare expenses and therefore controls the budget of the health plan. Generally, defined contribution providers charge a one-time plan setup fee and a monthly per employee per month (PEPM) administration fee. There should not be an annual renewal fee. See this overview of the cost of a defined contribution plan.

#10) Would we have a dedicated support person to assist our company?

In addition to setting up your defined contribution plan and processing the claims, look for a defined contribution provider that provides a dedicated account representative to support your business and a support team to help employees with their plan. Defined contribution support teams should be accessible, responsive, educated about defined contribution and health reform, and available by phone and email.

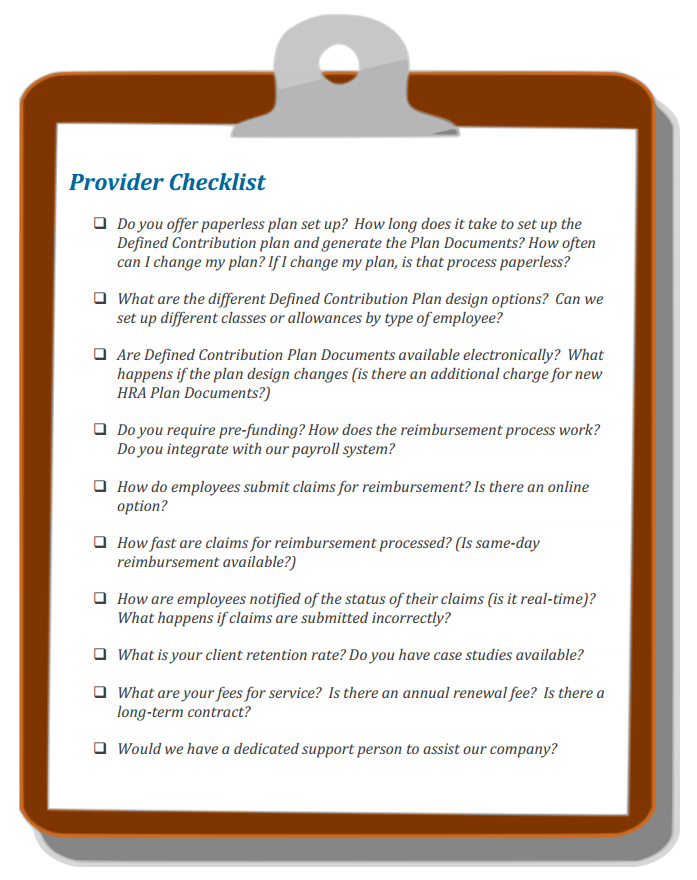

Defined Contribution Provider Checklist

Tip: A printable version of this checklist, and more defined contribution provider tips, are available in this defined contribution buying guide.

Tip: A printable version of this checklist, and more defined contribution provider tips, are available in this defined contribution buying guide.