Reconciliation of Individual Health Insurance Subsidy Payments

Affordable Care Act • July 31, 2013 at 3:00 PM • Written by: Christina Merhar

As part of the Affordable Care Act (ACA), starting in 2014 the federal government is making available health insurance subsidies to help eligible individuals and families purchase a health plan through the new health insurance marketplaces. It's estimated that up to 19 million people will receive health insurance subsidies by 2019, with the average annual subsidy estimated at $5,320 in 2014. The payments will be advanced directly to the insurance company through the marketplace, and the payments will be reconciled annually when the individual files taxes. This article provides an overview of how the subsidy payment reconciliation process will work.

How the Individual Health Insurance Subsidies Will Work

First, it's important to understand who is eligible for the individual health insurance subsidies, and how the subsidies will work.

Individuals are eligible if they meet certain income requirements, and do not have access to affordable health insurance through an employer or another government program. Eligibility is based on a standard called the federal poverty level (FPL). The subsidy will cap the cost of health insurance between 2% and 9.5% of annual income, depending on household income.

Individuals and families who earn up to 400% of FPL may be eligible. This translates to an individual earning up to $45,960 in 2013 and a family of four earning up to $94,200 in 2013.

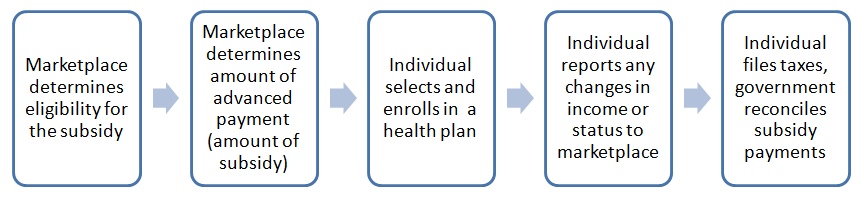

The health insurance subsidy process will work as follows:- Marketplace determines eligibility for the subsidy

- Marketplace determines the amount of advanced payment (amount of subsidy)

- Individual selects and enrolls in a health plan

- Individual reports any changes in income or status to marketplace (such as birth of child, marriage, divorce, new job, raised or increased hours, job loss, etc.)

- Individual files taxes and the government reconciles subsidy payments

Reconciliation of the Health Insurance Subsidy Advanced Payments

Whether individuals use prior year’s income, or more current income when applying for health insurance through the marketplaces and for the subsidies, it is likely that the income will be different from what is ultimately reported on their tax return.

The ACA requires that subsidies received over the year be reconciled against actual annual income when the individual files their tax return. The reconciliation process will verify actual income and determine if there was an over- or under- payment. Any overpayment must be repaid by the individual. An under-payment will result in a refund.

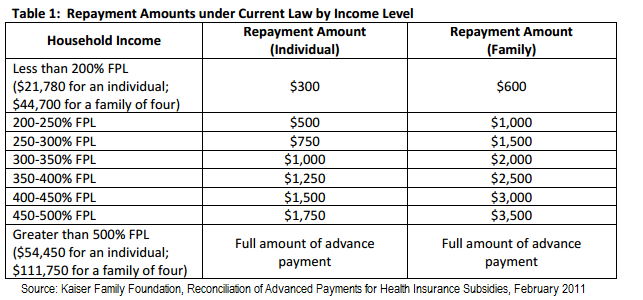

However, there is a maximum amount that individuals and families will be required to repay, based on their FPL. Individuals earning 200% FPL or lower will repay a maximum of $300 and families earning 200% FPL or lower will repay a maximum of $600. Here is a chart of repayment amounts, by FPL: