Individual Health Insurance Tax Subsidy Examples - Health Reform

Health Exchange • October 2, 2012 at 10:14 PM • Written by: PeopleKeep Team

Beginning in 2014, massive tax subsidies will be available to help individuals buy individual health insurance coverage through the new state-based public exchanges. Tax subsidies will be available, beginning in 2014, for individuals who enroll in silver plans through an exchange. This subsidy caps the cost of an individual’s health insurance at 2% - 9.5% of their household income if their household income is less than 400% above the federal poverty line (that’s ~$90,000 per year for a family of 4 in 2012).

If an employee’s employer doesn’t offer a “qualified” and “affordable” company-sponsored group health plan, the employee gets a federal subsidy automatically applied to the cost of their individual health insurance policy. Large employers are charged $3,000 per year for each employee who receives the subsidy, up to a maximum of $2,000 per year for all employees. Employers with less than 50 employees are not charged anything if their employees receive the federal subsidy.

Tax Subsidies on Individual Health Insurance will Cause Businesses to Drop Coverage

Due to these massive tax subsidies on the individual market, virtually every employer with less than 50 employees will switch from group coverage to simply giving employees tax-free allowances via HRAs to purchase their own individual health insurance policy. And, most large employers will follow suit once they realize how large of a subsidy their employees receive if the employer doesn’t offer group coverage. These examples should explain why:

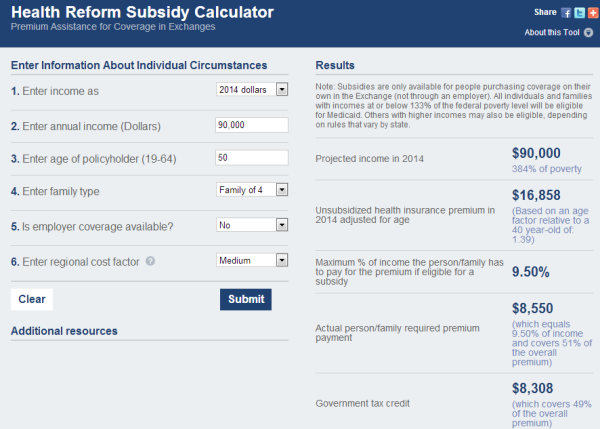

Example 1 – Family of 4 with $90,000 annual income

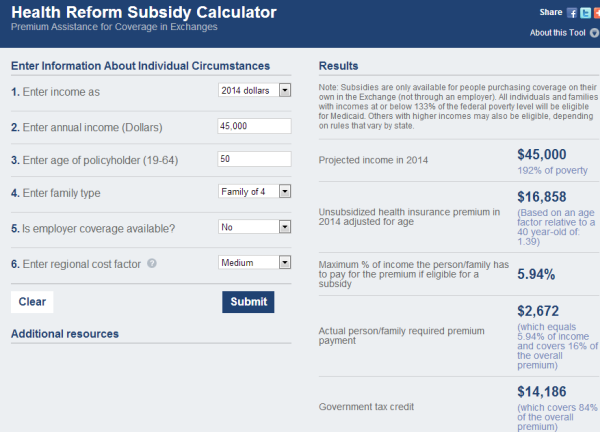

Example 2 – Family of 4 with $45,000 annual income

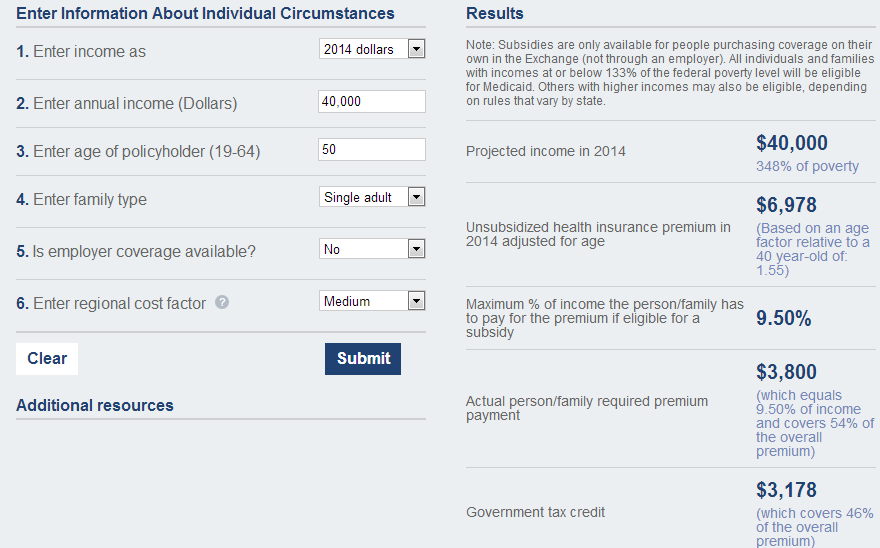

Example 3 – Single Person with $40,000 annual income

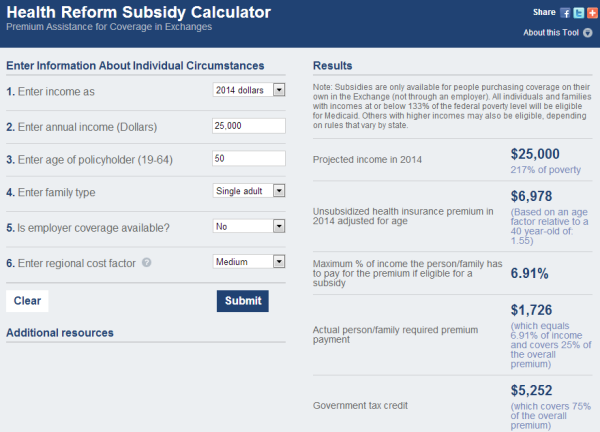

Example 4 – Single Person with $25,000 annual income

Notes about the calculations

For these calculations, I used the Kaiser Subsidy Calculator. The premiums are illustrative examples in 2014 dollars derived from estimates of average premiums from the Congressional Budget Office. For a 40-year-old single adult, the premium for a silver plan is assumed to be $4,500 for a plan with a 70% actuarial value.

Premium subsidies are based on a silver plan (with an actuarial value of 70%), so all premiums shown are for silver coverage. People may be able to pay a lower premium for less comprehensive coverage (i.e., a bronze plan, with an actuarial value of 60%). The tables showing results by age and income also reflect premiums for silver coverage, though the minimum insurance that people would be required to obtain would be bronze coverage.

The proposal also makes available a catastrophic policy for young adults and those exempted from the requirement to obtain insurance that is less comprehensive and has a lower premium than other coverage. It is not reflected in the calculator.

The actual premium calculated is adjusted for family type, and for age (within the three to one limit specified in the proposal). Subsidized people can enroll in more expensive plans, but must pay the full difference in the premium.