Four Ways to Save Significantly on Your Prescription Medications

Healthcare Costs • September 25, 2020 at 9:06 AM • Written by: Dr. Jessica Nouhavandi

COVID-19 continues to have a significant impact on the financial stability of individuals and families across the United States. Millions of Americans have lost their jobs and, as a result, their employer-provided health insurance. Even with insurance, many people struggle to afford their prescription medications. Although these problems existed in the U.S. healthcare system long before COVID-19, the pandemic has exposed and exasperated them further.

If you are underinsured or uninsured, there are alternative resources available to help you continue to access high-quality, convenient, and reliable healthcare. For instance, there has been a transformation of doctor services through telemedicine companies, which now make it possible to meet with a doctor from the safety of your computer for an affordable price without insurance.

The pharmacy industry has also gone through some startling changes recently. Below, we’ve listed four ways you can now save significantly on your prescription medications thanks to these changes.

- Switch from brand to generics

- Pay out-of-pocket (cash prices) instead of co-pays

- Switch to an online pharmacy

- Switch to a 90-day supply

Generic medications are just as safe and effective as brand-name medications. They have the same active ingredients, the same dose, and the same number of pills.

The difference?

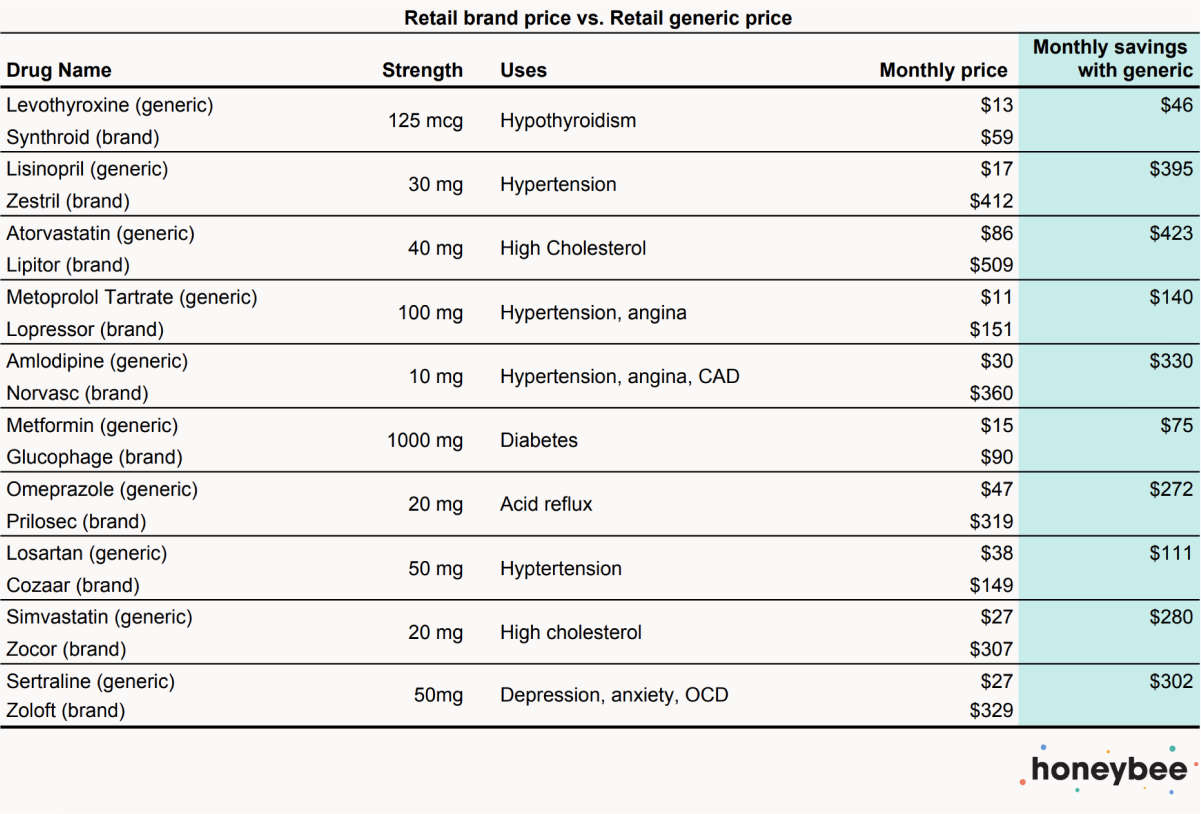

Generic drugs are much cheaper. Pharmacists at Honeybee Health put together a table showing the cost savings of switching to generics for ten popular maintenance medications below. Overall, they found that switching to the generic can save an average of $237 a month.

*Drug prices of each medication were calculated based on a comparison of the same strength, form, and once-daily dosage using GoodRx data based on average prices at major retail stores.

Most people assume that the copay from their insurance company is the lowest price for a prescription medication. However, copays are actually often much higher than the true cost of the medication. That is why you can save significantly by skipping insurance altogether and paying out-of-pocket for your prescription medications instead.

Pharmacies like Honeybee Health purposely do not accept insurance and instead offer medications at near-wholesale cost. That means you can save up to 80% on your medications at a pharmacy like Honeybee Health—all without using or worrying about insurance.

You no longer need to wait in long lines or risk exposure to COVID-19 by picking up your prescription medications in-person. Instead, you can use online pharmacies like Honeybee Health to have your medications delivered straight to your door.

Overall, we’ve found that the out-of-pocket cost at online pharmacies like Honeybee Health are around five times lower than the out-of-pocket cost at retail pharmacies. For example, a popular generic prescription medication is atorvastatin (Lipitor), which is used to manage high cholesterol. The average cash price for 30 tablets is $79.52 at retail pharmacies. At Honeybee Health, the cash price for 30 tablets of Lipitor is $9.

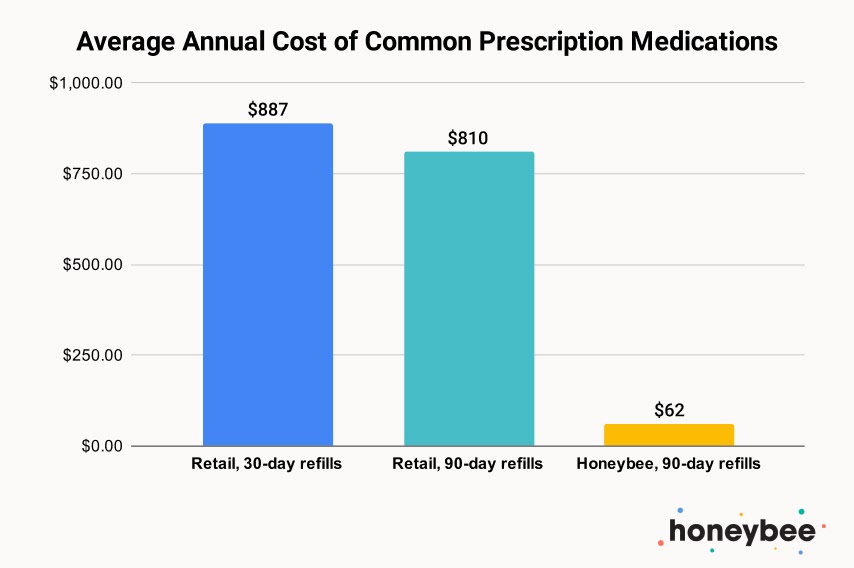

If you take maintenance medications--such as those used to treat chronic conditions like high blood pressure, high cholesterol, anxiety, depression, or type 2 diabetes--it can be much more affordable to buy a three-month supply at a time instead of just a one-month’s supply at a time.

For example, atorvastatin (Lipitor) costs on average $79.52 per month at retail pharmacies, resulting in a cost of $954.24 per year. If you switch to buying 90-day refills, you would only pay $819.28 per year on average. By buying in bulk, you’re saving $134.96 per year.

*Prices for 30 and 90-day supplies of each medication were calculated based on a comparison of the same strength, form, and once-daily dosage using GoodRx data based on average prices at major retail stores. The sample strength chosen was based on Drugs.com maintenance dosage for each medication. Medication prices are subject to change.

To use this trick, you often have to order from an online pharmacy like Honeybee Health that doesn't require insurance, as insurance companies sometimes put restrictions on the number of refills you can pick up at a time.

Honeybee Health is an accredited online pharmacy that provides high-quality, low-cost generic prescription medications without insurance. You can save on your medications by searching for them on www.honeybeehealth.com. You can also always contact their pharmacists regarding any other questions about your prescription medications.

%20(1)%20(1).jpg)