Health reimbursement plan comparison

With so many options to choose from, knowing which health reimbursement arrangement (HRA) is best for your organization can feel complicated. We've simplified the comparison process, helping you easily identify which plan is best for you.

Fill out the form to get access to our comparison chart.

Our four-page comparison chart includes:

- Information on how each health reimbursement arrangement compares to one another

- Compliance requirements for each type of HRA

- Insights on which HRA would fit your organization's needs best

Why choose an HRA?

Accessible to all employers

An HRA is a much simpler alternative to group health insurance that isn’t subject to annual rate hikes and has no participation or minimum contribution requirements.

Empowers employees

An HRA empowers employees to choose the insurance plan that works for them. Each employee can use the benefit differently to purchase the expenses that make sense for their personal health, budget, and family situation.

Tax advantages

HRA reimbursements are free of payroll taxes for employers. Additionally, if employees are covered by a policy providing minimum essential coverage (MEC), their HRA funds are free of income taxes.

Who is PeopleKeep?

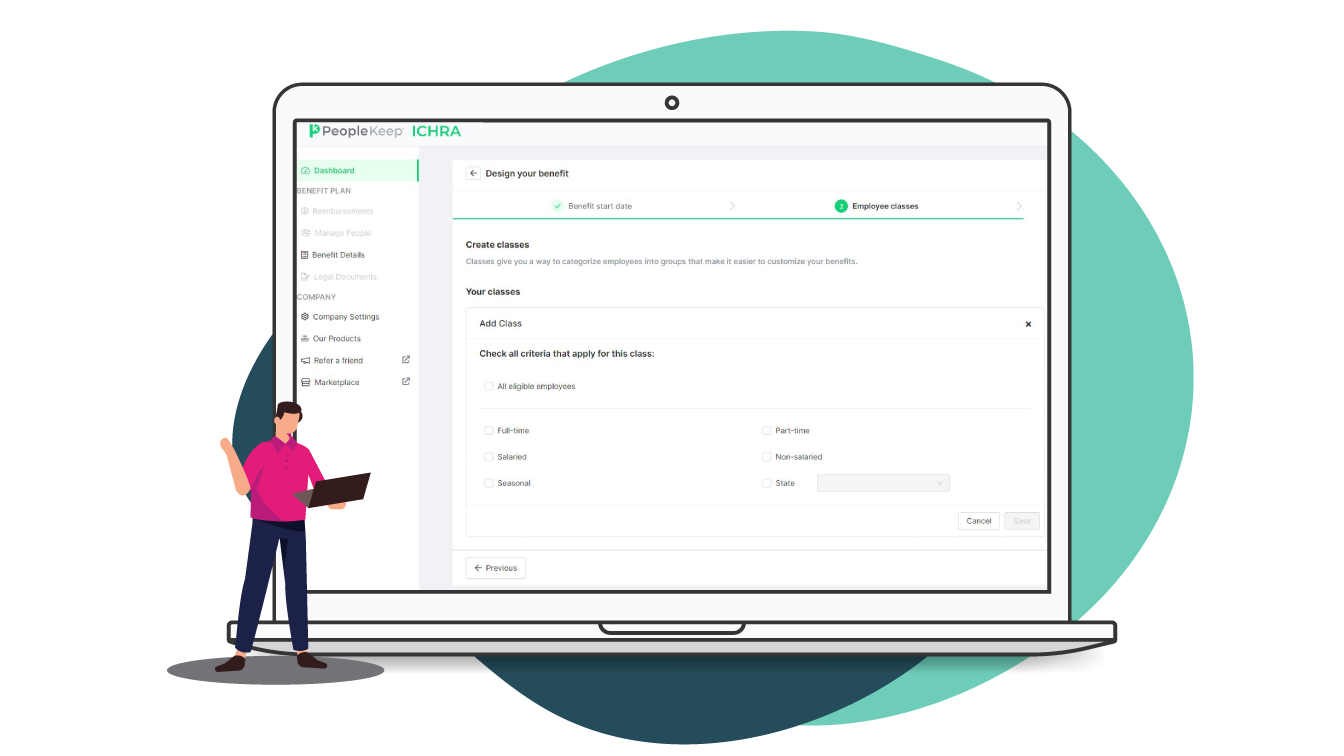

PeopleKeep offers HRA administration software that allows organizations to create individualized benefits packages to improve employee engagement and strengthen workplace culture.